I have a lot of vacation saved up for the end of the year, so I have to take quite a bit of it so I don’t lose any. (We, like many companies, can only carry so many days of one year’s vacation into another year. Part of the reason is so that people have to take vacation and not get burned out.) So I’ll be off the rest of the year, and this will likely be my last post of the year. When I return, we will have gone off the so-called "Fiscal Cliff", or we’ll have come to an agreement to avoid it.

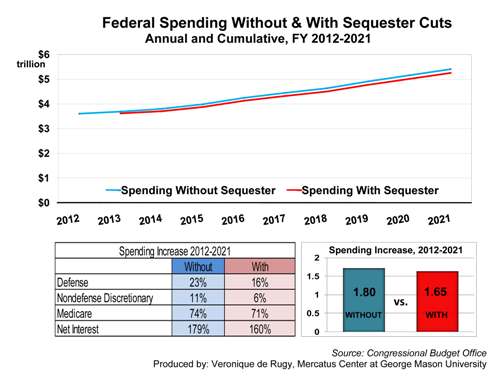

As the countdown to the Fiscal Cliff continues, tax increases seem to be the only way Democrats in Congress think that we can close the deficit gap. But Michael Barone points out that, no, tax increases alone will never be enough. It’s not the panacea that Democrats claim it to be. He covers some ideas that I’ve mentioned here, like the fact that entitlement spending alone is enough to keep a deficit going. You might think tax increases are helping, but we’d just be sinking slower. Some I’ve engaged in on this subject have said, “well, at least that’s in the right direction”. Sure, if you can hold your breath indefinitely. No, the right direction would be to start rising and get above the water level.

Another point is that higher tax rates don’t typically produce more tax revenue. From the 1940s to the 1960s, when the top marginal tax rate was 91% (91%!), tax revenues always bounced between 15 and 21% of GDP. Why? Because with a tax rate like that, people spend more time looking for tax shelters and other means, legal and illegal, to keep from paying those high rates. Thus, the Congressional Research Service notes that, during those times of 91% top rates, the effective tax rate on earners in the top 1/100th percent was 45%. Now, I understand that only income over a certain amount was charged that 91% rate, but even the tiniest sliver of earners at the very top, the absolute richest of the rich, were still paying an aggregate of less than half the rate. Some studies put it at 1/3rd the rate. This is simple pain avoidance. Threaten to poke me, and I’ll defend myself.

And so from 1948 until now, with up economies and down, with huge marginal tax rates and smaller ones, under Republican Presidents or Democratic, the total US tax revenue taken in as a percentage of GDP has stayed remarkably consistent in the same range; between 15 and 21%. The tax rate made precious little difference in how much of the economy was taken in taxes.

The lesson, then, is this: grow the economy and restrain spending. If we’re going to get the same percentage of the economy in taxes, then to get more tax revenue, you must grow the economy. And as Barack Obama himself said in 2009, “you don’t raise in a recession.” Now, you might say we’re coming out of the recession, but his proposal for $50 billion more in yet another stimulus says he thinks otherwise. Don’t read his lips; read his proposals.

But, once you get those increases revenues, don’t spend that and more on, well, another stimulus, which, by the administration’s own numbers, grew the economy and the jobs at a slower rate than doing nothing. No, taking more in is not a license to spend it. But it’s what government does. That’s why any deal which includes higher taxes may look like a healthy compromise, but it’s nothing more than a ruse that will put us further in debt.